コインチェックで暗号資産を購入したいんだけど、口座開設ってどうやったらいいの?

この記事では、Coincheck(コインチェック)の始め方がわからないという疑問がある方へ向けてCoincheckの口座開設の方法や、口座開設しようかどうか悩んでいる方向けに、Coincheckのメリット・デメリットを解説します。

まずは、Coincheckの口座開設方法を、4つのステップで紹介します。なお、当記事には広告・PRが含まれています。

目次

コインチェックの口座開設方法【4ステップ】

実際の手続き画面はこちらです。

- コインチェックにアクセスする

- メールアドレスの登録

- 本人確認

- 2段階認証の設定

この手順にそって進めていけば、簡単に10分程度で口座開設できます。

それでは、ひとつずつ順番に解説していきます。

①コインチェックにアクセスする

まずはコインチェックにアクセスします。

以下、コインチェックの公式サイトより画像を引用しています。

まずは会員登録のボタンを押して登録を進めていきましょう。

②メールアドレスの登録

コインチェックの会員登録ボタンを押すと、メールアドレスの登録画面になります。

画像引用元:コインチェック

メールアドレスとパスワードを入力し、チェックボックスにチェックをして会員登録を進めていきましょう。

③本人確認

会員登録が完了したら、次は本人確認を行います。

まずは、本人確認で電話番号認証の必要もあります。ご自分の携帯電話の番号を控えておくようにしましょう。

電話番号認証が完了したら、氏名・生年月日・住所などの基本情報を入力していきます。

基本情報の入力後、本人確認書類を提出することになります。

本人確認できる書類は下記の通りです。

- 運転免許証(表面/裏面)

- パスポート(顔写真欄と住所記載ページ)

- 個人番号カード(マイナンバーカード)(表面のみ)

- 住民基本台帳カード(表面/裏面)

- 運転経歴証明書(表面/裏面)

- 在留カード(表面/裏面)

本人確認の書類を提出したら、本人確認書類の写真と自分の写真を撮影し、再度本人確認作業があります。

④2段階認証の設定

最後に、Coincheckのアプリを利用するために2段階認証の設定を行なっていきます。

第三者によるログインや送金を防止するために、アプリを使った2段階認証の設定を行います。

2段階認証のアプリの中でよく使われているのが、「Google Authenticator」というアプリです。

「Google Authenticator」のアプリのダウンロードはこちら

「Google Authenticator」のアプリをダウンロードし、QRコードを読み取り表示される数字をコインチェックのサイトで入力すると2段階認証の設定は完了します。

以上でコインチェックの口座開設の手続きが完了です。

コインチェックへの入金方法

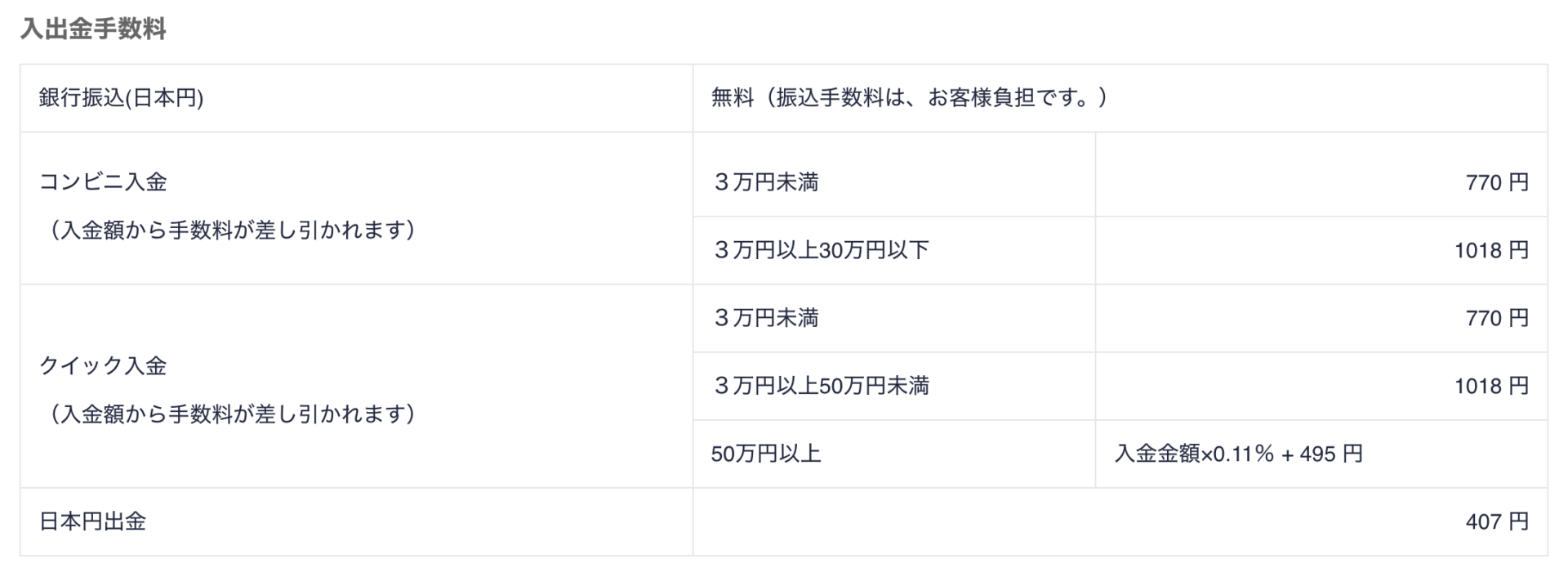

コインチェックへの入金方法は3つあります。

- 銀行振込

- コンビニ入金

- クイック入金

コインチェックに入金の際には手数料がかかります。

入金時の手数料は下記の通りです。

一番安い手数料は、銀行振り込みの振り込み手数料です。コンビニ入金やクイック入金は、金額に応じて手数料が発生します。

また、コインチェックから出金するときも手数料が発生し、上限額は1回あたり5,000万円に対して手数料407円発生します。

コインチェックの手数料とは

コインチェックで入出金に手数料がかかりましたが、暗号資産を取引するときも手数料が発生します。

暗号資産を入金する際は手数料が無料ですが、暗号資産を送金する場合は手数料が発生します。

また、暗号資産別で手数料が違うので注意が必要です。

暗号資産別の手数料は下記の通りです。

おもな暗号資産別手数料

-

- ビットコイン(BTC):0.0005 BTC

- イーサリアム(ETH):0.005 ETH

- イーサリアムクラシック(ETC):0.01 ETC

- リスク(LSK):0.1 LSK

- リップル(XRP):0.15 XRP

- ネム(XEM):0.5 XEM

- ライトコイン(LTC):0.001 LTC

- ビットコインキャッシュ(BCH):0.001 BCH

- モナコイン(MONA):0.001 MONA

- ステラルーメン(XLM):0.01XLM

- クアンタム(QTUM):0.01QTUM

- ベーシックアテンショントークン(BAT):130.0 BAT

- アイオーエスティー(IOST):1.0 IOST

- エンジンコイン(ENJ):99.0 ENJ

- パレットトークン(PLT):569.0 PLT

-

- サンド(SAND):82.0 SAND

(2023年10月現在)

自分が取引を希望する暗号通貨の手数料は、確認しておく必要があります。

コインチェックのメリット

Coincheckのメリットは3つあります。

- 国内最大規模の取り扱い通貨数

- 初心者でも使いやすい

- アプリが便利で使いやすい

それぞれのメリットについて開設していきます。

国内最大規模の取り扱い通貨数

コインチェックは、国内最大規模の取り扱い通貨数です。

コインチェックで購入できる暗号資産は下記のように27種類あります。

イーサリアム(ETH)

イーサリアムクラシック(ETC)

リスク(LSK)

サンド(SAND)

リップル(XRP)

ネム(XEM)

ライトコイン(LTC)

ビットコインキャッシュ(BCH)

モナコイン(MONA)

ステラルーメン(XLM)

クアンタム(QTUM)

ベーシックアテンショントークン(BAT)

アイオーエスティー(IOST)

エンジンコイン(ENJ)

パレットトークン(PLT)

ポルカドット(DOT)

フィナンシェトークン(FNCT)

チリーズ(CHZ)

チェーンリンク(LINK)

ダイ(DAI

メイカー(MKR)

ポリゴン(MATIC)

イミュータブル(IMX)

エイプコイン(APE)

アクシーインフィニティ(AXS)

ラップドビットコイン(WBTC)

他の取引所と比べて取り扱い通貨が多いので、それだけ運用の幅が広がります。

とりあえずコインチェックに登録しておけば、主要な暗号資産が購入可能です。

コインチェックの登録はこちら初心者でも使いやすい

コインチェックは、初心者でも使いやすいサイトデザインになっています。

暗号資産についてよくわからない初心者にとって、暗号資産のサイトは内容についてわからないことが多いでしょう。

しかしコインチェックのサイトデザインは、初心者でもわかりやすく簡単に取引できるようなサイト設計になっています。

欲しい暗号資産を選択し、購入したい数量を入力するだけで取引が完了します。

このようなシンプルな操作性こそ、コインチェックの人気の要因です。

アプリが便利で使いやすい

コインチェックのアプリは、使いやすいと評判です。

特に、2019年から2022年まで4年連続で「国内暗号資産アプリダウンロード数」NO.1に輝いている実績があります。

※ 対象:国内の暗号資産取引アプリ、データ協力:AppTweak

また、アプリはiOS・Android両方に対応していて、セキュリティ対策も万全です。

アプリで利用できる機能は、チャートや時価評価額の確認だけでなく、日本円の入出金、暗号資産の購入や売却、受け取りと送金もできます。

コインチェックはアプリ一つですべての取引が完了できますね。

コインチェックを使うデメリット

続いて、コインチェックを使うデメリットを2つ紹介します。

- スプレッドが広めに設定されている

- レバレッジ取引サービスがない

それぞれのデメリットについて、解説していきます。

スプレッドが広くに設定されている

コインチェックでは「スプレッド」という目に見えない手数料のようなものが広くに設定されています。

スプレッドとは、暗号資産を「購入する価格」と「売却する価格」の差額のことを言います。この差額が実質の取引所への手数料となっています。

コインチェックではこの差額が広く設定されているので、暗号資産を購入するときには注意が必要です。

レバレッジ取引サービスがない

コインチェックにはレバレッジ取引サービスがありません。

レバレッジ取引とは、預けた金額を担保により大きい金額の取引を行うことです。

コインチェックでも以前はやっていましたが、現在はこのサービスが終了しています。

コインチェックで取引したいなら、現物取引のみになります。

まとめ:暗号資産を始めるならコインチェックなら簡単です!

ここまでCoincheckの口座開設方法やコインチェックのメリット・デメリットを紹介してきました。

コインチェックの口座開設は、下記の4ステップで簡単にできちゃいます。

- コインチェックにアクセスする

- メールアドレスの登録

- 本人確認

- 2段階認証の設定

コインチェックは、最短で10分もあれば口座開設して取引できますので、気軽に登録してみましょう。

\Coincheckの口座開設/